In the fraud alert audience, a scam victim who hopes others avoid her painful experience; what you should know

When AARP Virginia volunteer Shannon Abell recently delivered one of his many fraud alert presentations, this one was far different than most, even if he was not aware until after he finished speaking. Among those paying close attention was a woman — we will call her “Victoria” at her request — who had painfully learned less than six weeks earlier that sophisticated con artists can and do scam active and able people of any age. In Victoria’s case, she was taken for $20,000, leaving her “devastated,” and it is why Abell and others in AARP make fraud awareness and prevention a key priority.

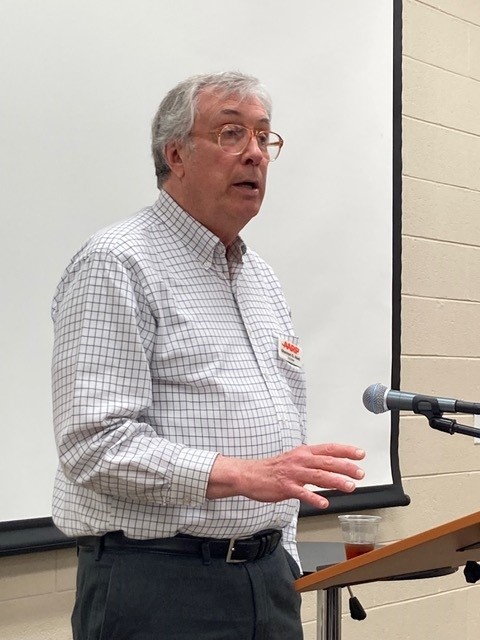

Speaking in April to seniors at Roanoke County’s Bonsack Baptist Church, Abell recounted many of the most common forms of fraud attempts by phone, over computers, through a mailbox or by someone knocking on your door. Then he cited the recent case of an area woman who removed $20,000 from her bank account and deposited all of it in a cryptocurrency machine at a nearby convenience store. In the audience, Victoria knew much more.

It started with an email in March purporting to be a “suspicious account activity” alert. Before it was over, the scammers convinced Victoria that child pornography actors were laundering profits through her bank account — even showing a phony $20,000 account deposit on her computer screen. In order to avoid prosecution on child porn charges, the con artists said she must withdraw that amount as quickly as possible. Not long thereafter, Victoria deposited 200 $100 bills, one by one, into that cryptocurrency machine, each one representing another $100 untraceably and forever stolen from her — and adding up to $20,000 now owed to her bank.

Abell devotes much of his presentations on how to prevent fraud, and he says it is wrong to believe that only those with cognitive deficiencies are susceptible to such scams. Victoria would agree. At 78, she is still active and employed and never considered herself a likely victim. She hopes AARP presentations like this will inform others on how to avoid being scammed before they, too, become victims.

Scammers can approach you in many ways, so here are some of the key things to remember from AARP:

- Never click on links on texts or emails in a text or email notification. Instead, go to the bank’s website (even if you’ve signed up for text alerts). Use the URL listed on your statements or that you’ve previously bookmarked, and check for any alerts on your account.

- If you get a robocall or call from someone claiming to be from your bank, hang up. Then contact your bank in a way you know to be legitimate, either online or by calling the phone number on your statement or debit card.

- Never provide account data or personal info. As ABA's Banksneveraskthat.com website explains, “our bank will never ask for your PIN, password, or one-time login code in a text message. If you receive a text message asking for personal information, it’s a scam.”

- Don’t rely on caller ID. Scammers can use technological tricks to display actual bank phone numbers or even the name of the bank.

- Be wary of a message or caller insisting that you take immediate action. Scammers try to put you under pressure to act quickly, to make it more difficult for you to think clearly.

Have you or someone you know experienced fraud? The AARP Fraud Watch Network Helpline has volunteers to help.

- Call the AARP Fraud Watch Network Helpline at 877-908-3360 or report it online with the AARP Scam Tracking Map.

Keep up with the latest scams with the AARP Fraud Watch Network.

To request an AARP speaker for your group, visit https://www.aarp.org/virginiaspeakers.