In Case You Missed It: A Social Security Conversation with AARP Utah

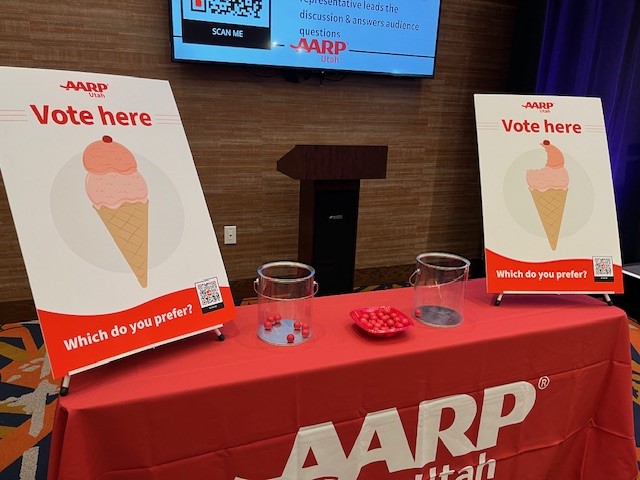

On May 22, 2024, AARP Utah held an in-person Social Security forum at the Embassy Suites Hotel in South Jordan. We were joined by about 75 attendees as our experts discussed Social Security solvency.

The discussion was moderated by Heidi Hatch, an anchor/reporter at KUTV News. The panelists included Robert Griffiths, an adjunct professor at Brigham Young University, and Dianna Cannon, an adjunct professor at the University of Utah.

The Social Security program, a cornerstone of American financial security, was signed into law by President Franklin D. Roosevelt in 1935. It was designed to provide financial support to the elderly, unemployed, and disadvantaged Americans, funded by payroll tax contributions.

“The program was very minimal in the beginning, really only to take care of people in the direst of circumstances,” said Professor Griffiths. “Since then, it has become one of the main pillars of retirement for older Americans. By the 1980s, it was clear that the program as it stood would not be able to handle the retirement of the baby boomer generation come the next few decades.”

Over the years, the program has undergone several amendments to expand its coverage and adapt to changing economic conditions. Today, Social Security continues to serve as a critical safety net for millions, ensuring a measure of economic stability for retirees.

Each year, the Trustees of the Social Security program release a report on the current and projected financial status of the program. The 2024 report reveals the Old Age Survivors Insurance and Disability Insurance (OASDI) Trust Fund will be able to pay 100% of scheduled benefits until 2034. Beginning in 2035, the reserves will be depleted, and the program income will only be able to pay for 77% of scheduled benefits.

“The problem now is that it’s [the Trust Fund] running its course and it’s soon going to end,” said Professor Griffiths. “In 2035, according to the most recent report, they expect the Social Security Trust Fund will be exhausted and we will have to go back to the way it was originally done as a pay-as-you-go system where the only money that can be taken out is the money that is going in through payroll tax. And they estimate there will be about a 20% reduction in payout benefits. So, unless we want that to happen, and we don’t, something needs to happen.”

“The one thing I find most people will ask me about is, it sounds to me like it [Social Security] won’t be there at all. And that’s just not true,” said Professor Cannon. “I think that’s the message most people get because I have that question repeatedly in my practice. And no, it is going to be there … it might just not be 100% of what it is today”.

Heidi Hatch, Moderator: “We know that ensuring Social Security’s solvency will be tough, and likely require some tradeoffs. What do you see as the most likely changes that could pass that would ensure Social Security’s solvency?”

Professor Griffiths: “There are a number of things that can be done to deal with the problem. First of all, probably the easiest thing would be to raise or eliminate the ceiling on income that is subject to payroll taxes. The second would be to gradually raise the age of eligibility [to receive benefits]. It would be something gradual that people could prepare for over a few years. We could face the possibility of raising the payroll tax or reducing the cost-of-living adjustments. None of these are pleasant things, but the idea, as it was back in the 1980s, that if you do a little bit of everything, the pain wouldn’t be so bad for everybody.”

Professor Cannon: “So, it might be better to do a little bit of everything, but I think raising the payroll tax … I bet if you raise it from 12.4 to 15%, we might be able to solve the problem for 100 years. We could do that gradually as well. If you’re making $10 million a year, maybe you should pay your share of those [payroll] taxes and it could help solve the problem. Most people are retiring around the age of 62 and it’s usually because they are having health problems, and they are not able to work anymore. So, it seems to me that raising that age [of eligibility] isn’t the best choice.”

Professor Griffiths: “If you’re getting older in years and are getting worried about what life is going to be like in retirement, I would encourage you to maintain good relations with your children and grandchildren”, Professor Griffiths jokingly added.

Heidi Hatch, Moderator: “How do we ensure any proposed changes to Social Security do not disproportionately impact vulnerable populations and ensure fair treatment for all recipients?”

Professor Griffiths: “It’s a difficult question – when you talk about trying to take care of vulnerable populations through the Social Security program – you first need to realize there are still a lot of people who don’t get Social Security at all. You have to work for at least 10 years in order to even qualify. But for many people, particularly women who are homemakers and don’t work for a decade to pay into the program. So, you could imagine expanding the Social Security program to simply include all Americans and that would take care of some of the most vulnerable populations.

Professor Cannon: “There’s the issue of income, women make less than men. If we can solve that problem that would solve the issue for many women. I bring that up because women usually rely on Social Security more often than men, they make less money than men, and they also live longer. So, they are more reliant over the course of their lifetime and if we could solve some of those inequities, we could have a fairer system later on.”

Professor Griffiths: “The problem is this fairness issue. A lot of people feel the Social Security system is fair because they say, ‘if I pay in, then I should get something out. If somebody doesn’t pay in, why should they expect to get something out?’ Then there’s the issue of the very rich, some say, ‘well they don’t need it’, but who’s to judge who needs what, that’s always another difficult question. They paid into it, so why shouldn’t they get something out of it? It’s an all-around tough question.”

Heidi Hatch, Moderator: “While people are concerned about Social Security being there for themselves, many are really worried about it being around for their kids. Can you talk about your thoughts on how Social Security will look for the next generation who are going to need Social Security just as much as we do, if not more?”

Professor Cannon: “I don’t think it’s going to disappear, and I also don’t think it’s best to privatize Social Security. I do want it to be here for my kids – but I think everyone has the same issue, as I do, that we need to start saving now for their future.”

Professor Griffiths: “If the only discussion we have about the future of Social Security is, one- don’t raise taxes and two- don’t lower benefits, then it’s not going to be very productive. There are a lot of solutions that can be worked out with bipartisan consensus. The changes that need to happen don’t have to be terribly painful. They can be done in a bipartisan way, and they can be done gradually. But to cut off discussion is not going to work. So, when political leaders try to address the issue, we support them in the discussion. And we don’t support other politicians who shut down other politicians because they are willing to speak about these hard issues.”

Heidi Hatch, Moderator: Thank you to both Professor Griffiths and Professor Cannon. Discussions like this are extremely important and we need to help continue the discussion. We need a lot of ideas [to help solve this] because some of those ideas are going to be bad. Sometimes I think oh, I could solve that problem, but somebody else says- well did you think about this on the other side? So, we need that conversation to happen where people come up with the bad ideas and good ideas so we can figure out the best way forward.”

- AARP Utah University’s Most Recent Webinar on Social Security

- When Should You Claim Social Security

- 5 Social Security Claiming Options for Married Couples

- Social Security and Inflation

- Navigating Social Security

- Social Security Calculator

- Take Action Now to Protect Social Security

- Social Security Administration

- Find a Social Security Office in Utah

Moderator and Panelist Biographies:

Heidi Hatch is an award-winning anchor and reporter at KUTV-TV 2News, the CBS affiliate in Utah. She most recently moderated Utah’s first prime-time gubernatorial debate.

Professor Robert Griffiths is an adjunct professor at Brigham Young University. He’s a retired diplomat who spent 34 years as an economic officer for the U.S. Department of State.

Professor Dianna Cannon an adjunct professor at the University of Utah. She’s also the managing partner at Cannon Disability Law, P.C., where she specializes in Social Security Disability law.